Is there any industry that wasn’t affected by the rapid pace of machine learning and artificial intelligence development? Perhaps, the whole world is changing under the influence of this and other interrelated technologies, and the financial industry is no exception. What’s more, the use of machine learning in banking opens up a lot of new opportunities for secure transactions, higher profits, better customer experience and even fighting global problems like terrorism financing and money laundering. In this article, we decided to find out what are the use cases of artificial intelligence in banking while paying some more attention to the investment opportunities using this tool.

Fraud Detection with Machine Learning for Banking

So, what’s the essence of bank fraud detection with machine learning? In a nutshell, the technology is capable of lighting fast analysis or real-time data while taking invisible patterns and anomalies into account, and thereby, providing the most accurate suggestions on whether this or that user action is fraudulent or legit.

However, machine learning and artificial intelligence in banking are not used for fraud detection analysis only. These technologies have a lot of curring-edge opportunities for investing and risk assessments, insurance, and loans issuing marketing, and customer service improvement. Surely, there are a lot of ready-made solutions (for example, the one created by SPD group top AI development company) that financial company owners may utilize for their benefits.

AI and ML Fraud Detection vs Old Approaches

If we compare the possibilities of machine learning in banking with the approaches that were used before the advent of AI and ML, it will be clearly obvious that more innovative solutions have a lot of potential for financial companies and banks since they are:

- Fast

- Efficient

- Secure

Unlike old-school tools, machine learning algorithms are capable of analyzing data in real-time. What’s more, they are able to take the huge data arrays into account and reveal the slightest t and invisible patterns that may be indirect sights of a planned fraud attempt. Also, there are almost no ways to cheat this system which makes credit card fraud detection using machine learning especially efficient. However, sometimes the relentless vigilance of machine learning leads to false positives, which are definitely bad for the customer experience. However, since many artificial intelligence solutions are capable of learning from their own mistakes, the likelihood of such an incident recurring is zero.

In terms of security, machine learning-based systems embedded in banking business processes are also extremely difficult to hack, as they are integrated with the latest security tools, including two-factor and bio-authentication.

How Is Machine Learning Used in Investing?

Investing has always been a higher risk process, plus emotion-driven investment decisions, as a rule, have nothing good to promise. Machine learning in investment may help solve this and some other problems. Here is how it is used when it comes to making risky but potentially profitable decisions.

- Analysis

Any investment decision begins with an analysis of the potential profitability of this or that action. However, the capabilities of AI and ML surpass the potential of the human mind several thousands of times. Thus, AI better copes with data analysis and can gain more knowledge of the investment environment in several seconds.

- Comparison

Next, with the essential knowledge already gained, it makes sense to analyze several investment opportunities to find out the best deal. In this case, the artificial intelligence algorithm may also take into account the real-time data, for example, stock fluctuations to suggest the best desision possible.

- Prediction

After the analysis is done, the artificial intelligence in banking may make some predictions about the strategy that will be as beneficial for the investor as possible.

- Risk evaluation

Also, if there are some strategies to choose from, an AI algorithm evaluates the level of risks per each. Depending on the ways the AI model is programmed, it may either cut off all the offers that don’t correspond to the accepted level of the risk. or suggest an investor analyze all of them on his own.

- Decision making

Next, it may either suggest to an investor some of the best investing desision or make the decision on its own. However, only the investor decided whether to place the suggested bet.

- Automated investing

The last level of AI investment tool evolution is making an investment without the participation of the human.

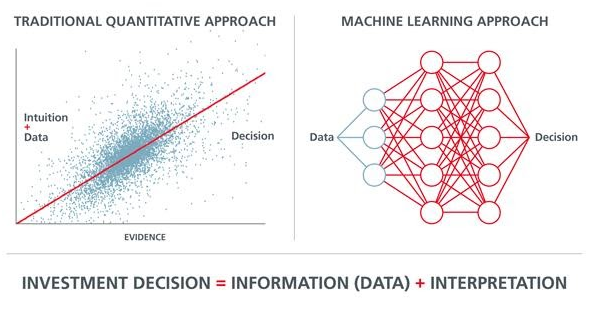

The picture below clearly explains how AI-powered investing tools deal with data to find the best investing desision possible.

What Are Machine Learning-Based Investment Strategies?

According to the Investing Data with Machine Learning using Python research, “There are many new strategies and approaches in investment management today. While the industry debates active versus passive investing, machine learning investment algorithms have become a significant player. All of these changes affect managers, investors, and vendors. Managers must now consider scalability and evaluate their long-term business strategies”.

Below are some of the investment strategies examples.

- Value Investing

- Income Investing

- Growth Investing

- Small-Cap Investing

- Socially Responsible Investing

Traditional vs ML Investment Strategies Comparison

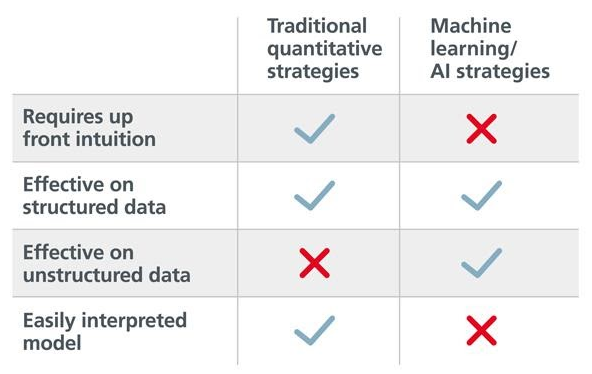

Also, if we compare traditional and machine-learning-based investment approaches, we will notice that both of them are effective when the data structured, however, traditional approaches need some intuition and are easily explainable, while machine learning investment approaches are based on facts and analysis only, while the desision made may be based on the whole set of invisible patterns and predictions. However, you shouldn’t be too surprised if it turns out to be the only right.

How is Machine Learning Used in Investment Management

As for artificial intelligence in banking and investment case studies, below are the main ways to use these technologies for highly profitable investments.

| Portfolio management and client enablement | AI can help with managing customers’ or financial institutions stocks’ portfolios by staying up to date with the best deals avalibale. |

| Automated insight generation | Because of the possibility of real-time data analysis, the users may have a lot of instant insights on stock fluctuations and investment strategies. |

| Relationship mapping | Also, since artificial intelligence has еруthe highest-end analysis and comparison skills, in the investment process it is possible to get even deeper insights about the relationship of certain factors, their influence on each other, and the profitability of the investment operation in the end. |

| Growth opportunities | With the help of predictive analytics and math skills of AI, it becomes possible to find out what are the growth opportunities for this or that stock or any other asset. |

| Powering risk performance | As we have stated, AI opens up a lot of opportunities for risk assessment, and none of them is intuition-based. |

| Reporting and servicing | AI-powered chatbots may also be a part of investing software for banks and financial companies to make the user experience even more seamless. |

| On-demand reporting | Also, it will be quite easy to generate an automated report and access investment performance. |

Conclusion

Thus, machine learning and artificial intelligence in banking and investment have a lot of promising opportunities. What’s more, these features may come as a part of even more innovative software for fraud prevention, customer experience boosting, risk assessment, and other relevant needs for financial business.