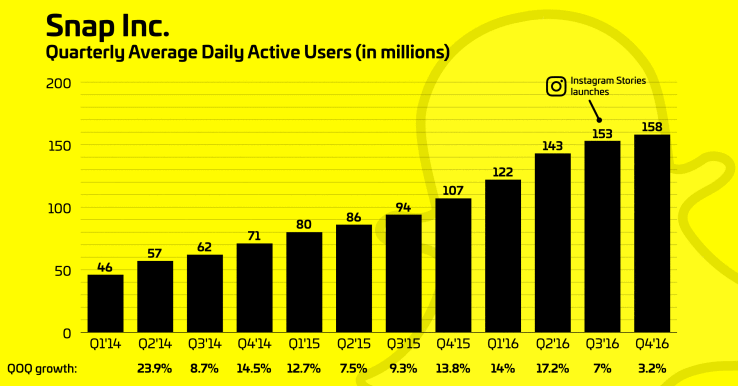

Snapchat has been under the world’s eye ever since it advertised its intent for an IPO. The people keeping the closest eye on it are none other than investors around the world. When it was made public, with the ticker symbol of SNAP, on 2nd March, 2017, the share was more than everyone had predicted originally. While the predictions put the share at $14-16, it actually launched at $17 a share, which was a huge deal. And it shouldn’t be a surprise to anyone; after all, Snapchat has millions of daily active users through the globe. Add to that the fact that other social networking platforms had successful IPOs previously, investors had every reason to believe that Snapchat would see a similar fate. But, the question is, should you buy Snapchat stock and invest in this growing platform?

Well, we all know that investments come with the inherent risk of failing when you least expect them to. Stocks crash and you end up losing money instead of gaining it. So, before you make the decision of whether you should buy Snapchat stock, you really need to think about whether it’s a good idea to. While we may not be qualified to make specific predictions regarding the Snapchat stock or give you solid investment advice, we can help you on your path to making the right decision. How? By giving you some information regarding how to assess risks and how to determine whether an IPO makes sense in the financial terms or not. Once you have gone through these tips, we believe you will be in a better position to decide if you should buy Snapchat stock.

Should You Buy Snapchat Stock or Not?

So, we have all heard of or used Snapchat and we know how big a part of the social media world it has become. The more you hear about a brand, like Snapchat, the more likely you are to think you know it well, that you know what the brand stands for. It allows us to get more comfortable with the values the brand represents. But, you should never buy stock depending on your own feelings about a brand, because often we are biased and our judgment is clouded. So, to make the proper decision, you first need to look at the current situation without any personal feelings involved.

The moment Snapchat went public, it has been facing difficulties. The very fact that it had to compete against Facebook, which continues to surge, meant the Snapchat would face some losses. Those losses, mentioned in Snapchat’s first ever earnings report, came at a hefty $2 billion in earnings. The stock price of Snapchat reflects this loss and it is expected to increase further. With the “lock up period” approaching, it is expected that the stocks will get another blow. What is the “lock up period”? It is basically the time period when employees and internal investors are not allowed to sell their stocks. Why? Because doing that leads to dumping of shares at launch.

After the lockup period, more and more shares begin to emerge in the market, and the prices change accordingly. The estimates suggest that the locked stock is six times more in volume as compared to IPO that was initially released. Can you imagine the effect that will have on the stock price if it were to be dumped altogether? Some reports also suggest that about 957 million shares are currently locked down, which may hit the market after the lockup period. While the average daily trade is about 18 million, a 957 million share would mean approximately 53 trading days to get rid of all the shares. This is all theoretical of course, but if it were to come true, Snapchat would take a massive hit. And since its stock price has already went down by 38%, this hit could be troublesome.

Of course, you may be wondering whether the “buy low and sell high” concept would work in this situation. If the prices do drop, would it be good to buy Snapchat stock and sell it when they rise again? Depends on whether those prices are likely to rise again or not.

Let’s Assess the Risk

So, IPOs are never definitive. They always have the element of price volatility associated with them because there are a lot of unknown factors involved. For instance, there are no trading records for IPOs so their valuations may be, and often are, inaccurate. Therefore, when considering the stock, investors don’t have a lot of information to work with. However, to be fair, such fluctuations were seen by Facebook, LinkedIn and Twitter as well when they were first released to the public. So, SNAP going through these fluctuations isn’t that big a surprise or problem.

So, while you assess the risks of a stock, there are some things you need to consider. These are called primary overt risk factors, which include: regulatory, reputation, competition and future strategy. When it comes to Snapchat, there is at least a medium level risk in all four of these factors. What does each of these include though? Read below for some more information:

- Regulatory – This consists of all the scrutiny that companies are under by the government. It determines whether the company is operating under an industry that is highly regulated or not.

- Reputation – As the name suggests, this factor deals with the reputation of the company; whether it’s good or bad. The reputation is determined particularly in reference to the company’s dealings and whether there is anything in the company’s future that could potentially affect it.

- Competition – Again, as the name suggests, this factor evaluates the industry and sees whether the company has any competition in the market. So, this factor would look at whether there is any other company that provides the same product or service that Snapchat does.

- Future Strategy – This factor is the most important, as it is the key to a company’s success. Why? Because a company has to look to the future, evolve and come up with new, innovative ideas if it is to remain in business.

There is more on IPO risk that you can learn from the website El1te Trader, which you can easily access by visiting www.theel1tetrader.com.

How to Buy Snapchat Stock

Alright, so if you’ve gone through all the details of the Snapchat stock, and still want to buy it, then the first thing you need to do is get a broker or brokerage firms and websites. These are what allow you to enter the stock market and buy the stocks you want. Now, whether you should get a broker or a brokerage depends on how much you want to invest. If you want to invest a lot, then you’d be better off with a broker. But, if your investment is going to be low, then you could easily get by with a brokerage website. Some of the stock trading websites include Merrill Edge, E*TRADE, Fidelity and Ally Invest.

There are a lot of things you need to consider when you’re selecting a broker, for example their fees, commission and minimums. While some brokers charge a flat fee, others charge fees that vary according to the volume. The minimums refer to the minimum balance for your trading account, which again depends on your broker; some need the minimum to be in thousands of dollars while others require no minimum at all. You also have to be careful about the fees that the brokers charge, and on what. For example, some brokers charge fees on inactive accounts, while some charge IRA fees and other fees according to the services you make use of. Research these fees before you select the broker you want to stick with. Another thing you should look at while selecting brokers is their reviews and the customer service they provide.

If, however, you want to go the path of a brokerage website instead of a broker, there are again some things you have to research and consider. The first thing you do when you need to start using such a website is register an account and sign a lot of forms. After that, you have to link a trading account and load some money in it. Once your account is all set up, you can go ahead and buy the shares you want for the stock you want, in this case SNAP.

One thing you have to keep in mind while buying the shares is that the current price you see and the price you pay may differ slightly because it is always changing. After that, you will probably see a list of fees and commissions the website will be charging you, in addition to the total amount you have to pay. You can then hit buy which will submit your order and purchase the stock as soon as possible. As soon as it is purchased, your account will be updated automatically. Another factor to consider when selecting a broker or brokerage is the speed and order execution.

So, if you think you have all the information you need to get started, go ahead and start buying the stocks you need!