Residing in the world that is driven by technology and the online world, many kinds of purchases that we make are usually online whether it is buying groceries, to ordering your favorite make up online to getting that hoodie you cannot stop obsessing over that you just saw on a Facebook page, all of it require a simple entry of your credit card number or a few clicks here and other on your online banking account and there you have made a purchase!

Consequently we have shifted from going to stores to staying warm and cozy at home and shop online which is convenient and okay to do as long as you are following the extra steps of protection for keeping your personal information safe and secure. We have come up with these 5 top tips and tricks which if you adopt will allow you to make safe online transactions.

1. Enable a Secure Connection when making a transaction!

Any connection that claims to be secured has essentially as SSL encrypted internet access that puts a layer of filter over all tasks you are performing online so that unauthorized people lurking online, trying to hack on to your network can stay the hell out of your way. An SSL encrypted network comes in highly useful when you are using a public or open internet connection. There is a fine line between a secured and an unsecured connection which is actually just an “s”:

- Https:// is a secured connections

- Http:// is not secured

Here is what you can do a little extra

If you have installed Mozilla Firefox as your web browser you can download and install an add-on known as “HTTPS Everywhere” which actually strengthens the security of your browser by immediately making use of the SSL protected forms of web pages that are accessible online. For the users of Google Chrome an extension with the name of “Prefer HTTPS” can be used to allow web pages for loading secured forms of HTTPS given that they are available for access.

2. Figure out if the website can be Trusted

If you do have to make online payments make sure the website you are doing it at can be fully trusted and are legit. Entering your personal details particularly the information on your banking details or passwords or pins is like inviting the devil in your life. Try searching on the reputation of the websites by reading comments or contacting the brand at the given emails or contact numbers. You must also make use of secure gateways when you have to make any purchase online. For instance AlertPay and PayPal are two highly renowned and trusted services that are used by millions to make payments such as for Netflix or other purposes.

Here is what you can do a little extra

You can also visit Web of Trust at mywot.com to verify the credibility of a website where you are about to make an online payment. This is a service that is fee of cost and givens a free add on for your browser that not only keeps you apprised on any malwares, viruses or bugs but also alerts you on scamming scandals and bad online shopping sites. They compile their data on user rating from the feedback of millions of users as well as other sources.

3. Keep a regular track of your Transactions

When you have a highly busy and tight schedule that you hardly get time for sleep it becomes next to impossible on staying updated on your transactions even on a monthly basis if not weekly. But try browsing through your bank’s billing statements to check on what you have been buying particularly eyeing the dates and place you purchased something from and the try highlighting any transaction that seems unknown. This way you can block your card and report the unknown transaction.

4. Secure Your Passwords

You must have noticed that now whenever you are making an account that asks you to create a password that actual process of creating a password is so tedious that soon they might be demanding sacrifice of a virgin to verify your password! However the perk of this can be seen when you make transactions online.

Online Banking doesn’t require you to state your whole pass code or pin in one step rather its is divided in multiple verification steps so that if someone is claiming to be from your bank asks for your complete password you know it is a red alert. Many banks are using the 2-factor authentication service where a special pass code or number is sent on your mobile phone in form of a text each time you have to make an online transaction. Your purchase then will only be made once you have entered the correct pass code. . This verifies your identity in two ways first by entering your password, and then by confirming that you have your phone.

5. Remember to leave on trail behind

If you are ever required to share your baking or personal details to a friend or family member using a text or email make sure you delete the sent data and prompt to the receiver as well to delete the text or email from their end as well once the work is done. There are many instances and events where accounts are accessed by unauthorized scammers simply because people are leaving their details around carelessly. Also make a habit of never noting down your password. You may misplace the paper or notebook on which you have written it and it can be used anywhere for wrong reasons.

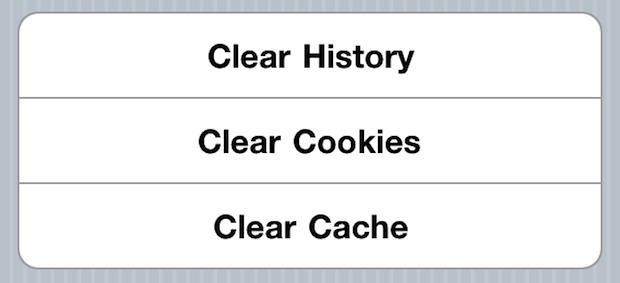

You should add multiple layers of vigilance on you when you are using somebody else’s computer to make an online transaction. Remember to choose “No” whenever a browser prompts you to “remember your username or password.” Regularly clear the history of your browser as well as cookies and caches.

Useful softwares such as Keepass and a cleanup tool like CCleaner can prove to be extremely handy for coming up with secure passwords and then also delete the data from the web browser once the work is done.