Money transfer is not an easy job and to transfer a big sum of money not only takes time and energy but also takes space. You need to have and control the money and a safe way through which you can transfer all that money and cash. so, what can you do? There is a system called the ACH system that helps you transfer your cash from one place to the other but the problem is that that system can sometimes be corrupted. That is where you ask the question What is ACH fraud.

Now, before we actually get into the whole how does this happen and how you can prevent it lets just talk about something that is the most important thing. The transferring of money from one place to another. Now that has been a dilemma all of our lives and the best and the worst thing about it is that we have managed to get amazing stories out of it and also learned lessons. In olden times people used to transfer money in carriages with soldiers on the side because of the fear of robbers but that is changing. Now we don’t have carriage’s and we cant have soldiers roaming the streets now, can we?

Then we went to vans and cars protected by and with bulletproof glass so you could transfer the money and no one could get in and still somehow the thieves got in and got the money. A lot of movies helped make that happen too because they gave excellently and thought-provoking ideas. Then lastly, they decided we should just do it electronically or online. This means that the money now can get transferred through a safe passage from one financial company to another and from one bank to another with no fear or lapse in security or any other issue. But alas, man is nothing if not consistent in doing a sin.

What is an ACH?

ACH or Automated Clearing House is an electronic network that helps transfer money and transfers financial transactions within the United States. Whether you are a bank or a company if you transfer the money or your finances through ACH then you will see that it helps because the people at Automated Clearing House are professional and resourceful. They hire experts and professionals who handle all the money and make sure that the transference is done well and that you will be able to give and receive the exact amount of money that you deserve and not a penny more or less.

The basis of having an ACH is to understand that it is not a manual process so the amount of error or the amount of fraud should be less and less due to the simple fact that it is not being handled by the company employees but by a machine that is programmed to do its job and nothing else.

What Is ACH Fraud and How Does It Happen?

Now that you are aware of what an ACH is supposed to do and the way it is supposed to be done the one thing and fact that you should also be aware of is the fact that there are people in this world that will have to be evil no matter what. No matter how hard you try to protect something the one thing they will do is find a way and get you away from the thing that they want the most. ACH Fraud is the same thing. ACH Fraud is when hackers and sometimes certain companies manage to get some financial gain from the system by rigging it or making it obsolete.

Hackers have found a quick way to siphon the financial statement while they are being transferred from one place to another and while that is happening they are getting rich. This is a very sophisticated way of dealing with a lot of money and amount.

Now the real question is how does it happen and what is the way to do it. The simple answer to that is a very sick and twisted way. All they do and have to do is make sure that the one operator in the company, a legitimate company gets hooked on ACH and then tells the client that a certain amount will be taken out of their accounts for the purpose of charity. Who wants to say no to a charity? So, the customer agrees and the company then proceeds to steal the money and live off it. By the time the customer gets their receipt the damage has been done and the operator has run off with the money and now the bank can’t do anything so they have to help the customer with their own cash.

So, the question does still remain, how do they do it? Well, to put it in simple terms would be easy and less time consuming but the one thing that you can do no matter what the situation, you can use pictures and visual aid to help memorize and understand the step-by-step procedures and instructions. The reason for that is that it helps with the whole usage of an understanding of the system.

So here we go:

- First, an operator tells you, the client that a certain amount will be taken from your account for the purpose of charity because whoever says no to a charity is a monster so you don’t say no and you let it happen.

- By the time the customer, you, get the receipt of the transaction a see that it did not go to any charity and even if it did it was a bogus charity it will be too late because the bank will notice it then and by the tie they figure out the scam the operator will have quit his/her job and run away with the money.

How to Prevent ACH Fraud

Now, this is a bit of a catastrophe because not only does it affect the client and that his money was scammed it also hugely affects the investors and the bank. The reason for that is because then they are liable to refund and help their customers with the protection of their money and that the customers came to them with the aim of knowing that their money is safe, since it was stolen by an operator or someone affiliated with the bank the bank is now responsible and the bank needs to repay the customers full price.

Although that is a way to go about it the real question is how can you prevent it and are there any preventive measures that can be taken that will help stop or even reduce this kind of action?

So here are some of the ways that you can prevent this from happening to you or to someone you know:

- Educate customers, if you are the bank, and educate yourself as a customer about the many features that can help protect the account and keep it safe and secure. Use check cashing limitations and automatic payment filters to protect your money.

- As a customer, if you need to transfer a large sum of money, do so from a stand-alone, hardened and locked down the computer from where you can’t even browse the internet. This will secure your transaction and help prevent fraud.

- Be very cautious of emails that are from bans that are not yours and emails from the government or any other agency that is requesting your verification or your account number or your pin number. Be very cautious.

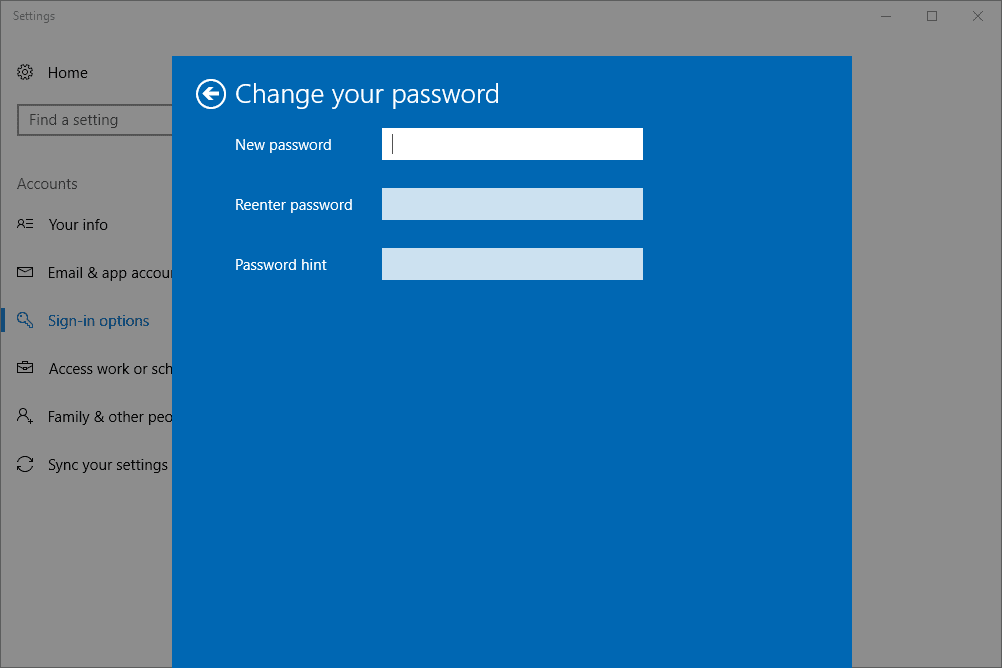

- Create a strong password for your bank account and make sure that it is hard enough for no one to crack but also easy enough for you to remember it.

- Install and active and committed firewall software that will protect and secure your account in case of any harmful file or advert or any out of the normal occurrence. All you need to be able to do is make sure that the security is top notch.

- Every website you access to make sure that the password and the username that you use are different and strong. Again, this is important because if you have the same password or the same username for all the accounts then the possibility of you being hacked increases by a significant amount.

- Also, install an anti-virus for industrial adverts especially because they are the ones that can cause a lot of problems. Pop up ads are always there and if you accidentally click on the one you will be taken to an unknown site and so you need a firewall to protect you.

- Finally, please change your password every year at least to secure your accounts and networks. This will help a lot with your security.

Conclusion

This entire article and its sole purpose were to help you understand what ACH is What is ACH Fraud and how can you prevent it from happening to your employee or to yourself. Hope this article has managed to help you in all the way that it could.